Broker & group hierarchies

69% of insurance execs say fragmented systems are slowing down growth

Disconnected data. Inconsistent workflows. Outdated systems that were never built for how insurance actually operates.

From distribution to servicing, most teams are still struggling to see the full customer lifecycle — and it’s hurting speed, experience, and revenue.

Insurance ops are leaking revenue.

From quoting to renewal, disjointed systems are slowing teams down.

Carriers & MGAs

- 58% of insurers rely on legacy quoting systems.

→ Slow quoting, patchy updates, disconnected teams.

Agencies & Brokerages

- Only 40% CRM adoption due to manual workarounds.

→ Broken pipelines, low broker visibility.

Group Benefits Providers

- 65% lack account lifecycle visibility.

→ Missed renewals, no scalable cross-sell motion.

Advisor & Producer Networks

- 74% of life & annuity firms lack closed-loop advisor reporting.

→ IMOs/FMOs can’t scale onboarding or track book health.

What today’s teams need isn’t more software. It’s plugging the gaps that block growth — and finally making CRM work.

Life & Annuity

Streamline underwriting, reduce resources for risk evaluation and policy creation, and boost decision-making and operational efficiency. With our expertise, we help insurers revamp their operations for greater efficiency and customer focus. Let's tap into your data's potential with ou tailored services.

Agencies & Brokerages

Drive growth efficiently with our AI and automation solutions. Experience the benefits of digital-first technology, unified insights, and automated workflows. We also empower marketing managers to effectively run promotions for independent brokers, MGA's and agents.

Property & Casualty

Group Benefits

Learners' Insurance Playbook

Improve performance across the full insurance value chain—from upstream quoting and distribution to downstream renewals, servicing, and CX.

- Accelerate quoting — shrink turnaround times from weeks to days

- Unlock broker visibility — boost channel engagement and reduce blind spots

- Streamline renewals — centralize data across product lines, policies, and systems

-

Unify reporting — surface insights across distribution, underwriting, and service

Built with carriers, MGAs, brokerages, and group benefits providers in mind, this playbook is implemented directly inside your CRM — turning fragmented operations into connected, scalable distribution.

INSIDE THE CRM

The Lead Gen Engine

Your CRM-powered engine for smarter outreach.

From list upload to follow-up, this engine routes producers, partners, or policyholders by license class, geography, or channel—then scores and sequences them for outreach.

No duct tape. No compliance risk. Just growth-ready distribution.

Quote to Bind Automation

Automate intake. Accelerate quoting. Eliminate delays.

From intake to quote, every step is automated, tracked, and connected—no swivel-chair work, no delays.

Integrated risk scoring, smart forms, and dynamic routing move deals forward fast—and keep compliance tight.

Underwriting & Onboarding

One connected motion from intake to policy issued.

Route deals to underwriting with everything needed—automated intake, document capture, and data that actually matches your risk logic.

No gaps between systems. No handoffs lost. Just faster paths to bind.

Manage Policy Operations,

Policy Owners and Agents

Manage Policy Operations, Policy Owners and Agents

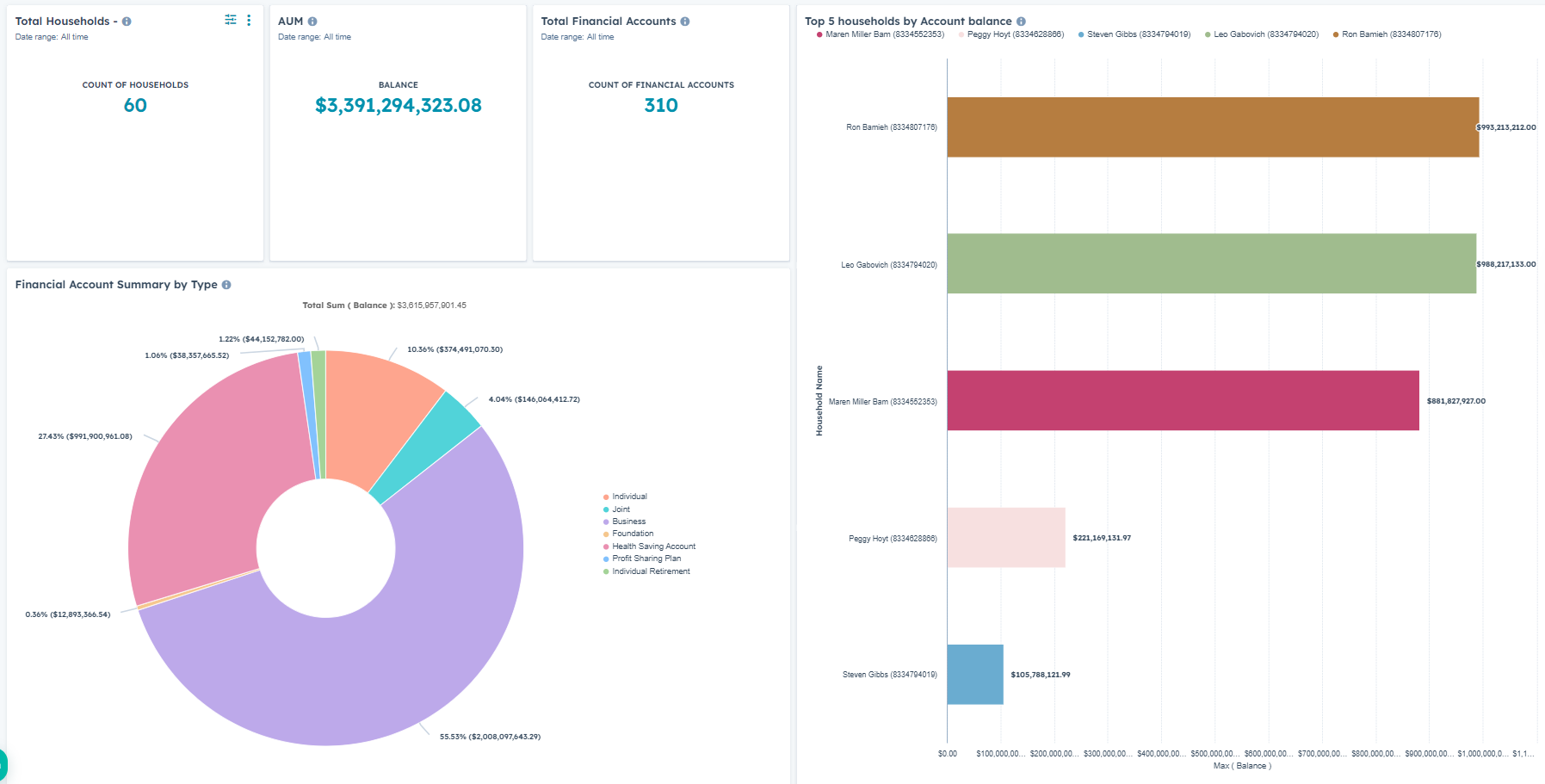

Surface not just “who”—but “who owns what.” Agents, accounts, assets, all linked in one place.

Whether it’s valuations, commissions, or policy data, everything connects—no toggling, no missed context.

Simplified Policy Operations

Claims. Renewals. Upsells. All in one connected flow.

Claims, renewals, upsells—all in one connected flow.

From first notice to re-engagement, this layer tracks, times, and nudges every policy action—automatically.

%202.png)

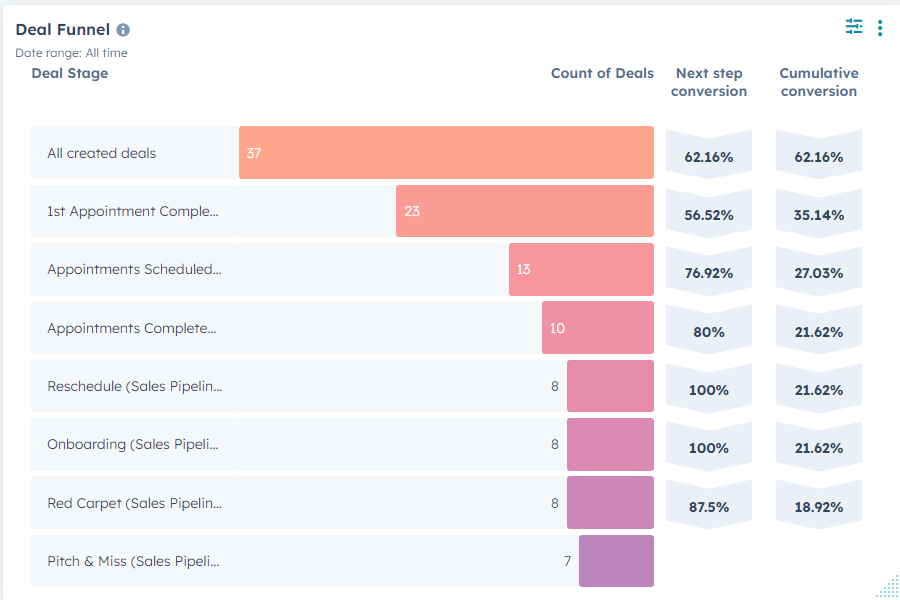

Attribution & Analytics

The source of truth for growth decisions.

Know what’s working, fix what’s not.

Track every step—from producer outreach to claim outcome—and see what’s driving revenue (and what’s not).

Whether you're leading distribution, marketing, operations, or executive strategy—this is the data layer that brings your business together.

No more guessing. Just one dashboard, for every leader.

WHY LEARNERS.AI

Built by Insurance CRM Experts

Founded by two CFA Charterholders with over 38 years of financial services experience, Learners.ai brings deep industry fluency to CRM transformation—built specifically for carriers, brokerages, MGAs, and benefits platforms.

Your dedicated implementation team includes:

-

RevOps consultants, data specialists, and solution engineers

-

Full-stack developers with deep CRM and HubSpot expertise

-

Specialists in advisor onboarding, compliance, and client engagement

We bring together CRM best practices with a data-smart, AI-augmented approach—to unify your distribution, servicing, and growth engines.

SERVICE & SUPPORT

Ongoing CRM Management—Built In

You’re not just buying software.

You’re building a scalable distribution and servicing engine—designed to grow revenue across your entire insurance value chain.

HubSpot Onboarding

Set up for scale, right from the start.

- Multi-Hub implementation

- Pipeline & lifecycle mapping

- Role & access controls

-

CRM Migration

- Data extraction & cleanup

- Data enrichment & mapping

- Custom object modeling

- Import & QA pipelines

Platform Integrations

Connect the tools your team already uses.

- Core systems (e.g. Applied Epic)

- Data (Snowflake, Redshift)

- Client portals & tools

- Mrk & call tracking platforms

Admin & CRM Ops

We help run the CRM so your team doesn’t have to.

- Pipeline & workflow tuning

- Segmentation & list builds

- Access & data hygiene

- User support & governance

Campaign Execution

Support your distribution & marketing teams.

- Email journeys & nurturing

- Campaigns for brokers

- Follow-ups by channel

- Dashboards & reporting

Growth Optimization

Turn your CRM into a performance engine.

- Conversion audits & testing

- Referral tracking workflows

- Attribution models

-

Growth & cross-sell strategy

Client Service

Power smarter service delivery with modern client tools.

- Client Portal & ticketing

- AI-powered chat & knowledge

- Satisfaction surveys

-

Helpdesk metrics by team

Operations & Compliance

Stay audit-ready with CRM systems designed for oversight.

- User Audit Logs

- E-signature tracking

- Call, quote, or claim interactions

- Client communication logging

Training & Adoption

We ensure your team gets up to speed—fast.

- Dedicated enablement team

- Hands-on Workshops

- Custom training sessions

- Videos & User Guides

Reporting & Analytics

A clear view across service, revenue & operations.

- Revenue attribution

- Producer productivity metrics

- Marketing performance metrics

- Claims, renewals & conversions

What our Customers Say

.png?width=400&height=108&name=a0933e835e5ccfab963a81f8e8b9e1ac%20(1).png)

Brett Oliveira

ShipHero Sales

Learners.ai has been an incredible partner for our HubSpot CRM rebuild and integration project. This has been a complex project completely rebuilding our CRM processes and workflows from the ground up while integrating numerous internal and external data sources. They have been incredibly responsive and provided great advice and best practices along the way. I'd definitely recommended working with the Learners team. Thank you!!

Chris G.

Forum Financial Management, LP

Love working with the team at Learners! From day one, they really got our business and took the time to deliver a custom solution that our whole team can get behind!

Jamal M

Main Street Financial Solutions

Learners did a fantastic job of understanding our perspective and at customizing an approach that met our needs, while still bringing much needed experience, structure and vision to our process. They clearly know their stuff when it comes to leveraging automation capabilities for financial services practices. It’s eye opening what automation can accomplish for our practices already, and I firmly believe that any RIA that hopes to stay relevant in the next decade ought to be investing in this critical area of technology NOW!

Cynthia LaRue

Forum Financial Management, LP

I chose Learners for our CRM implementation because of their experience, CRM expertise, RevOps expertise, competitive pricing, and their focus on customer service. They provided a full audit of our CRM and then a complete overhaul of our CRM, from custom objects & properties, to completely new sales pipelines, workflow automation, lead scoring, reports & dashboards. I would absolutely recommend Learners - they are outstanding and are true experts. They take a true team approach to the project and are very flexible.

Ashley Camire

Owner and Relationship Specialist

Learners.ai was a breeze to work with. Learners team is genuinely caring people who take their work and customers' projects very seriously... They are calm, friendly and very easy to talk to...Everything coordinated for us was organized, timely and within budget. YOU ARE NEVER ALONE, trying to figure anything out during the entire process. Thank you Learners team!

Brandon Palmer

Digital Marketing Manager

Our team is using Learners.ai for a fairly complicated reimplementation of our HubSpot CRM and Marketing Hub. That said, working with them has been wonderful. They're basically a part of the team now! I never have any issues reaching out to them and receiving a reply, and a solution to whatever issue I've discovered. We've been working together for approximately three months and it's been nothing but wonderful. Projects like this are tough and time-consuming, but Learners.ai has continuously been up to the task and handled any and all of our requests. Shout out to Learners team! They've been terrific.

Phil Desrosiers

Corporate Director

I have relied heavily on the team at Learners for the implementation of the new system. The configuration of HubSpot to meet our needs at my company has been a real game changer and we've already seen the results pay for themselves even before we've completed the project. They've gone above any beyond to provide expert advice and jump in when we've run into unexpected challenges. Should you decide that an integration team is the right fit for your growth plans at, I can confidently say with Learners you would be in good hands.

What our Customers Say

.png?width=400&height=108&name=a0933e835e5ccfab963a81f8e8b9e1ac%20(1).png)

Chris G.

Financial Advisor

Love working with the team at Learners! From day one, they really got our business and took the time to deliver a custom solution that our whole team can get behind!

Jamal M

Director of Insurance Services

Learners did a fantastic job of understanding our perspective and at customizing an approach that met our needs, while still bringing much needed experience, structure and vision to our process. They clearly know their stuff when it comes to leveraging automation capabilities for financial services practices. It’s eye opening what automation can accomplish for our practices already, and I firmly believe that any RIA that hopes to stay relevant in the next decade ought to be investing in this critical area of technology NOW!

Phil Desrosiers

Corporate Director

I have relied heavily on the team at Learners for the implementation of the new system. The configuration of HubSpot to meet our needs at my company has been a real game changer and we've already seen the results pay for themselves even before we've completed the project. They've gone above any beyond to provide expert advice and jump in when we've run into unexpected challenges. Should you decide that an integration team is the right fit for your growth plans at, I can confidently say with Learners you would be in good hands.

Chase M.

VP of Sales

We brought Learners.ai in to optimize HubSpot, and they delivered exactly what we needed: clarity and actionability. Before, tracking sales performance and card activations felt disjointed, and aligning goals with results was difficult. Learners customized HubSpot to give us real-time insights and built automations that made tracking far more efficient. Their ability to connect technical work to business development made a big difference. I now focus less on chasing data and more on driving performance. We’ve continued to retain them and I highly recommend them.

Melissa G.

SVP Customer Experience

Learners.ai helped us rethink how we approach CRM in banking as part of our digital transformation. They tackled deeper challenges like disconnected systems and inefficiencies. Their work integrating HubSpot with our core banking platforms created a unified system and actionable insights. Every phase was executed with precision, ensuring smooth adoption and helping us shift to a more data-driven, customer-centric operation. The real value was how they aligned with our vision. We’ve already retained them for the next steps and highly recommend them.

Amy B.

CRM Manager

The experience with Learners has been phenomenal. We partnered with them to implement HubSpot for our company as well as ongoing relationship as support. The team is professional, dedicated, driven, and a pleasure to work with. My role is CRM Manager, so I work very closely with Salman and his team.

How it works:

"HubSpot for Wealth Management" is the catalyst for transformation in the financial planning and wealth management industry, ideal for you if:

You're a Growth-Driven RIA: Looking to scale your practice while maintaining that personal connection? Embrace solutions that bring your personalized services into the digital age, from content tailored to your clients' needs to digital onboarding that feels like a handshake.

Independent Financial Advisors in Transition: If manual client segmentation and lead routing are holding you back, it's time to harness automation to refine your focus – empowering you to make financial guidance your masterpiece.

Wealth Management Firms Seeking Efficiency: Elevate client interactions and slash time spent on data entry. With "WealthTech in a Box," implement strategies that resonate personally with clients, automate engagement, and integrate your CRM for operations as smooth as silk.

Marketing and Sales Leaders with Vision: Keen on optimizing your outreach? Leverage A/B testing and deep analytics to forge connections with potential clients that are not just heard but felt.

Financial Planners and Consultants Aiming for Precision: Let AI-powered lead scoring illuminate your path, focusing your expertise where it makes the most significant impact – on prospects ripe for engagement.

RevOps Specialists Craving Synergy: If disconnected systems are your bane, our integrated solutions promise a cohesive ecosystem. Experience the synergy of business process redesign and digital transformation that boosts revenue and trims expenses.

FinTech Devotees and Innovators: Are you at the crossroads of finance and tech, seeking the next peak to conquer? Delve into the depths of financial planning innovation with bespoke customization, seamless integration, and automation that sets you apart.

It's Your Time to Lead

With "HubSpot for Wealth Management," the leap into tomorrow's wealth management landscape is not just a step but a stride towards leadership. It’s where your expertise meets innovation, where your practice not only adapts but sets the pace in a digital-first financial world.

Imagine a future where your insights are empowered by cutting-edge technology, where every interaction with your clients is both a moment of connection and a testament to efficiency. This is the future "HubSpot for Wealth Management" promises – a future where your practice is the beacon for those navigating the complexities of wealth in a digital era.

Seize the moment. Elevate your practice and redefine what it means to be a financial advisor in a world where technology and personal touch are no longer at odds but in harmony.

FAQ

Answers for Insurance & Benefits

01

What exactly does Learners.ai do for insurance firms using HubSpot?

HubSpot is a flexible CRM—but it’s not tailored to the insurance stack out of the box. That’s where Learners.ai comes in.

We reconfigure HubSpot to fit how real insurance firms operate, with:

-

-

-

- Custom data models for policies, accounts, producers, and quoting

- Seamless workflows across quoting, renewals, onboarding, and servicing

- Deep integrations with AMS, policy systems, and rating tools

-

-

Whether you're a carrier coordinating channel partners, an MGA scaling multi-state distribution, or an agency managing policy servicing at scale—we build a CRM that fits your business, not the other way around.

This isn’t a plug-and-play CRM.

It’s your sales and servicing infrastructure—built right.

02

How does this help my sales, distribution, or servicing teams day-to-day?

It makes your revenue teams faster, more coordinated, and easier to manage.

For Carriers & MGAs:

-

-

-

- Producers and partners get clearer quoting workflows and fewer bottlenecks

- Channel managers gain visibility into broker activity and pipeline

- CX and marketing teams work from shared data—no more swivel-chair chaos

-

-

For Agencies & Group Benefits:

-

-

-

- Producers stop chasing paperwork and start deepening relationships

- Account managers onboard and renew faster with automated reminders

- Leadership sees what’s stalling growth, and how to fix it

-

-

We streamline the handoffs, reduce the noise, and make your CRM a source of real operational clarity—not a mess of disconnected tools.

03

Is HubSpot secure and compliant for insurance firms?

Yes—and we make it even more so.

HubSpot offers enterprise-grade security: SOC 2 Type II compliance, GDPR, HIPAA (with Enterprise tier), audit logs, and permission controls.

But Learners.ai goes further. We:

-

-

-

- Configure role-based access to protect client records

- Align workflows with your internal compliance rules

- Set up audit tracking, retention policies, and permission groups

-

-

This isn’t a generic CRM install. It’s a tailored setup that satisfies your carrier, legal, and compliance teams.

04

Can you integrate HubSpot with our rating tools, AMS, or other core platforms?

Yes. Integration is our specialty—and we don’t break your systems to do it.

We’ve connected HubSpot to platforms like:

-

-

-

- Guidewire, Vertafore, Applied Epic, Salesforce, and homegrown AMS tools

- Document management systems and underwriting portals

- Quoting engines and payment processors

-

-

Your producers, CSRs, and account teams don’t need to juggle 4 tabs to get the full picture. We sync the right data, to the right people, at the right time.

05

What if our data is messy or stuck in legacy systems?

You’re not starting from scratch. Most firms aren’t working with clean data—we’re used to that.

We handle:

-

-

-

- Spreadsheet consolidation and deduplication

- Migrations from legacy systems like Salesforce, Redtail, and AMS tools

- Cleanup and normalization of policy, account, and contact records

-

-

You’ll walk away with a clean, structured CRM environment.

No more duct tape, no more data anxiety.

06

How long does implementation take?

Most firms go live in 3–4 months, depending on complexity and team size.

Our 6-Phase Implementation Framework:

-

-

-

- Architect – Align CRM strategy with your GTM model and workflows

- Design – Build frameworks for distribution, onboarding, renewals, and CX

- Build – Develop integrations with AMS, portals, quoting tools

- Deploy – Launch in phases to minimize disruption and ensure adoption

- Optimize – Drive usage with the right signals (renewal triggers, account health)

- Maintain – Support, refine, and evolve post-launch

- Architect – Align CRM strategy with your GTM model and workflows

-

-

We build it right the first time—and evolve it with you.

07

What kind of support and training does Learners.ai provide?

You don’t get left behind after go-live. We provide:

-

-

-

- Certified onboarding specialists to walk your team through every phase

- Role-based training for producers, CSRs, marketing, and ops

- Live workshops and recordings for adoption and new feature rollouts

- Ongoing support to troubleshoot, refine, and scale your setup

- Certified onboarding specialists to walk your team through every phase

-

-

This is a long-term partnership, not a one-time install.

08

Who on my team actually uses the CRM—and how?

The whole revenue team—not just your admins.

-

-

-

- Producers use it for pipeline, quoting, and follow-up

- Marketing teams use it for broker engagement and lead gen

- Servicing & renewal teams use it to automate tasks and track policies

- Executives use it for pipeline clarity and growth planning

- Ops & compliance use it to control data, workflows, and access

- Producers use it for pipeline, quoting, and follow-up

-

-

HubSpot becomes the central nervous system—not a silo on the side.

09

How much does it cost?

We scope every project based on your complexity, systems, and goals.

Variables include:

-

-

-

- Number of workflows, custom objects, integrations, and team sizes

- Migration or cleanup needs

- Post-launch support requirements

- Number of workflows, custom objects, integrations, and team sizes

-

-

No cookie-cutter pricing.

The best way to get a number is to book a call and let us tailor a solution to your firm.

Ready to learn more

On the call, we’ll review your integrations and identify any that need updating to keep working. Our team can give you an estimate of the amount of work required to make the changes.